cap and trade vs carbon tax upsc

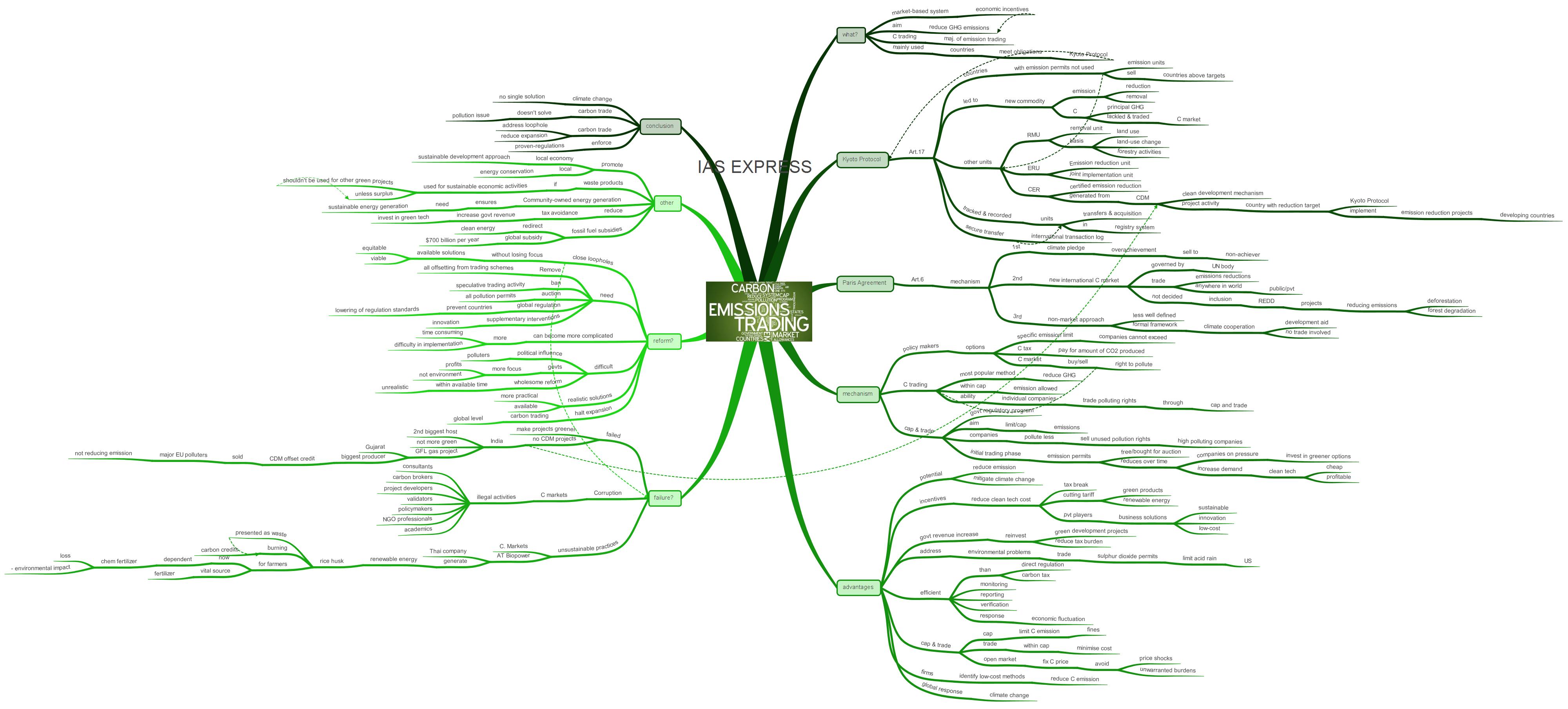

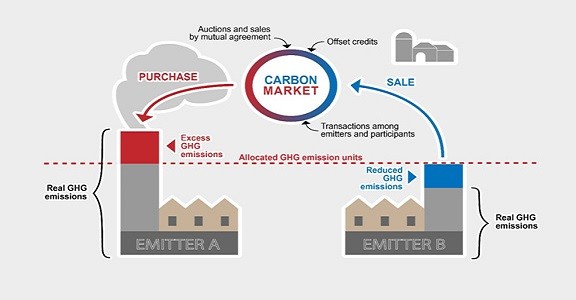

Emissions trading or cap-and-trade CAT and a carbon tax are fundamentally different tools to limit the effects of using fossil fuels. Lastly I also like the fact that a clear revenue is collected with a tax system.

Why To Impose Carbon Tax In India Important Topics For Upsc Exams Ias Exam Portal India S Largest Community For Upsc Exam Aspirants

A centrally-administered tax does not have the same flexibility.

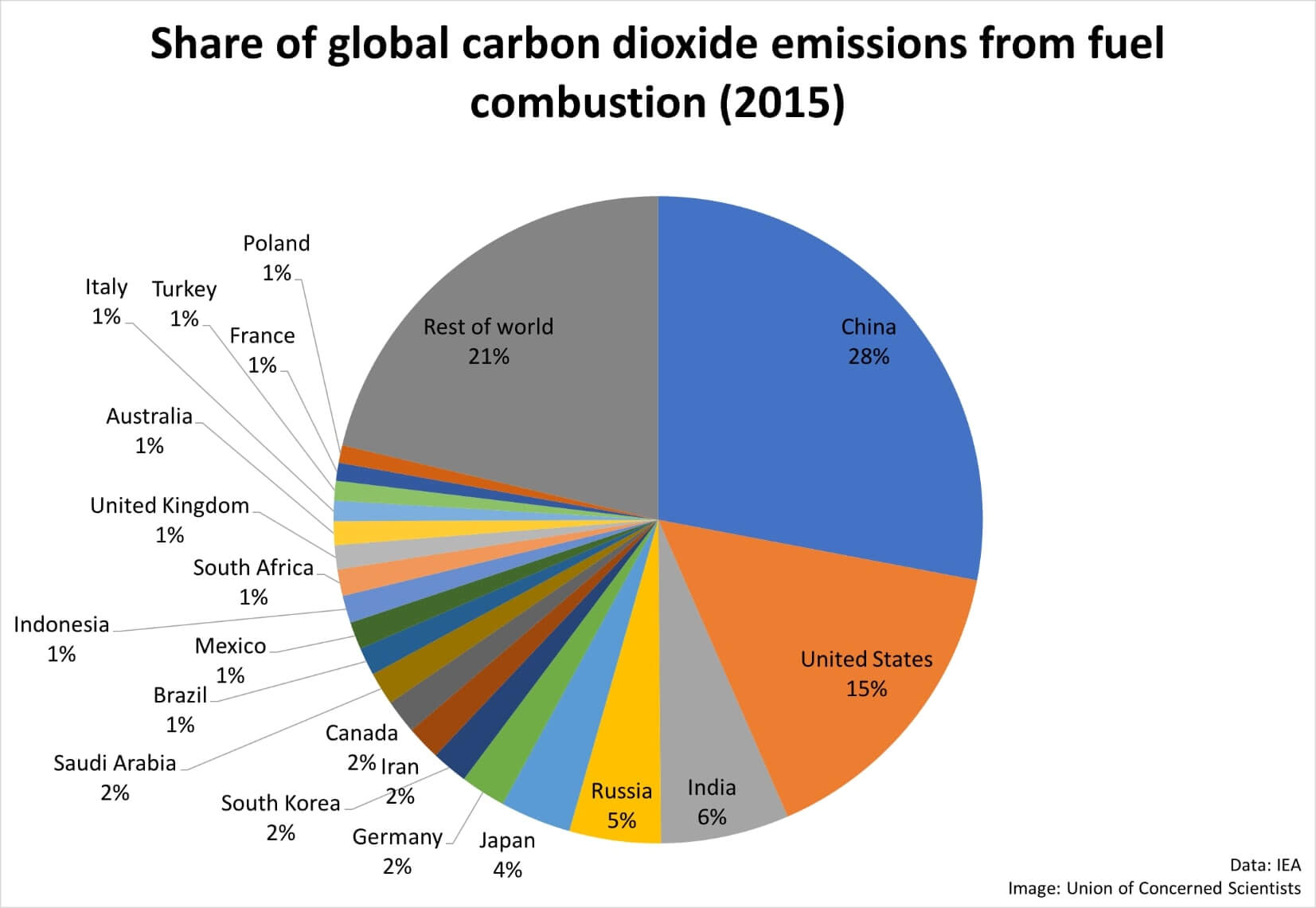

. Carbon taxes makes emitting carbon dioxide more expensive. There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some supporting carbon taxes and others favoring cap-and-trade mechanisms. Carbon taxes vs.

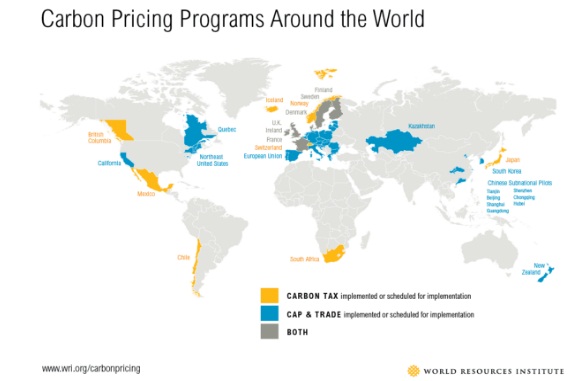

Today cap and trade is used or being developed in all parts of the world. Carbon tax the price of carbon or of CO 2 emissions is set directly by the regulatory authority this is the tax rate. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so.

A cap-and-trade system through provi - sion for banking borrowing and pos - sibly a cost-containment mechanism. Carbon taxes put an initial financial burden on entities that pollute. You can tweak a tax to shift the balance.

Cap-and-Tradethe approach most popular among politicianswould put a quantitative limit on annual carbon emissions by auctioning permits that power plants and other industries would have to purchase in order to burn fossil fuels whereas a Carbon Taxthe approach most popular among economistswould discourage emissions reductions by. With a cap you get the inverse. Consider the following statements.

For example European countries have operated a cap-and-trade program since 2005. The cap and trade system is thus functionally similar to a tax on carbon. A carbon tax and cap-and-trade are opposite sides of the same coin.

Political reality being what it is either is likely to impose a fairly low. The combination of an absolute cap on the level of emissions permitted and the carbon price signal from trading helps firms identify low-cost methods of reducing emissions on site such as investing in energy efficiency which can lead to a further reduction in overheads. The revenue generated from the taxation will also assist Canadians by ultimately facilitating greener practices by subsidization and funding environmentally conscious research.

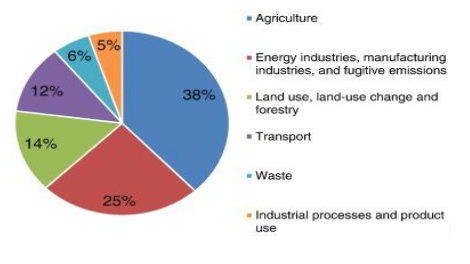

Carbon tax is based on the polluter pay principle. Carbon tax is Pigovian tax. I find Jeffrey Sachs points most compelling in the fact that a carbon tax covers the entire economy and reaches units impossible by cap and trade.

In contrast under a pure cap-and-trade system the price of carbon or CO 2 emissions is established indirectly. With a cap and trade scenario emitters have the flexibility to reduce emissions in the house or purchase allowances from other emitters who have achieved surplus reductions of their own. You can do the same to cap-and-trade.

Finland is the first country to. Finally the practicality of reducing emissions under a carbon taxation system is. The regulatory authority stipulates the.

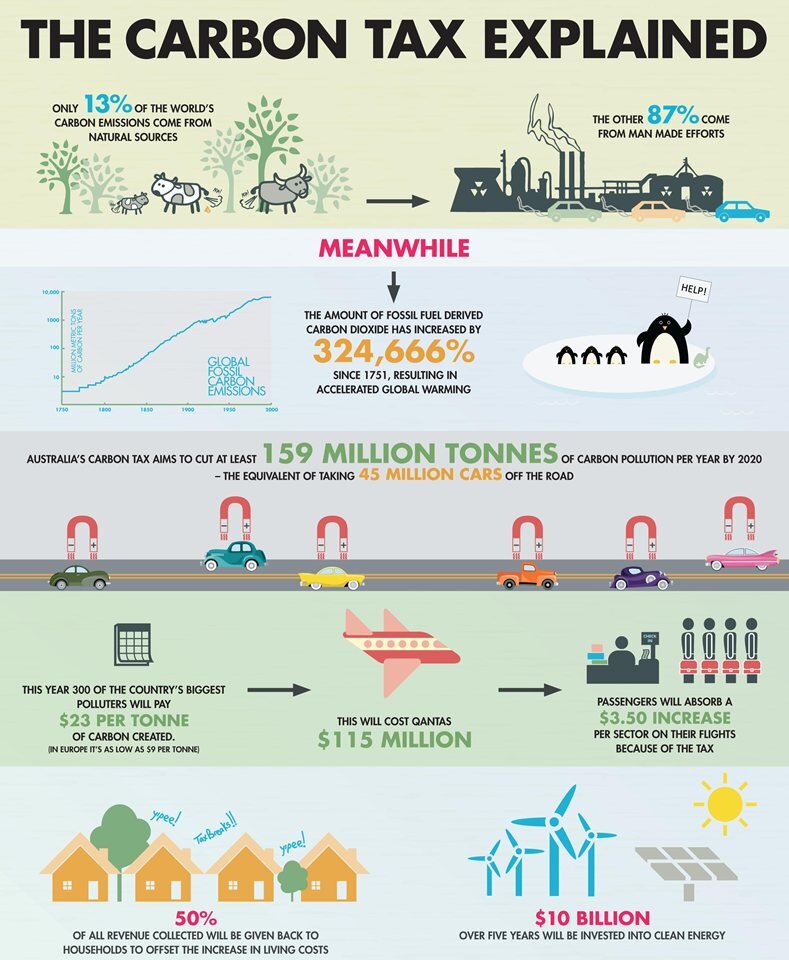

A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives. India imposed a Carbon tax of Rs 50 per ton of coal produced and imported in 2010. Carbon Tax India.

Economists have come up with to address climate change. On the other hand political economy forces strongly point to less severe tar - gets if carbon taxes are used rather than cap-and-trade which is why envi-ronmental NGOs are opposed to the tax approach. Several Chinese cities and provinces have had carbon caps since 2013 and the government is working toward a national program.

We show that the various options are equivalent along more dimensions than often are recognized. Both can be weakened with loopholes and favors for special interests. I also agree with him that a cap and trade market can be manipulated.

Mexico is running a pilot cap-and-trade program that the. Carbon tax the price of carbon or of CO 2 emissions is set directly by the regulatory authority this is the tax rate. As well with the carbon tax system there is more motivation to adhere to regulations because it will become a standard.

A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions. How do the two major approaches to carbon pricing compare on relevant dimensions including but not limited to. We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor.

As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. In 2015 it was further increased to Rs 200. In contrast under a pure cap-and-trade system the price of carbon or CO 2 emissions is established indirectly.

The regulatory authority stipulates the allowable overall quantity of emissions. Economic guru and former Federal Reserve Chairman Alan Greenspan has come out against cap and trade as an effective mechanism for reducing carbon emissions. Governments set the price of pollution while markets determine the amount of pollution companies can pollute and pay the tax or reduce emissions to avoid the.

In 2014 it was increased to Rs 100. No matter how much gets emitted a carbon tax makes the emission the same. Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences.

I am opposed however to the confused and misleading straw-man arguments that have sometimes been used against cap-and-trade by carbon-tax proponents. While there are tradeoffs between these two principal market-based instruments targeting CO2 emissions -- a cap-and-trade system and a carbon tax -- the best and most likely approach for the short to. In a carbon tax scenario emitters must pay for every ton of GHG they emit - thereby creating an incentive to reduce emissions in the house as much as possible to avoid the tax burden.

With a tax you get certainty about prices but uncertainty about emission reductions. Theory and practice Robert N. Indeed in stable world with perfect information cap and trade would be exactly equivalent to a.

I have grave doubts that international agreements imposing a globalized so-called cap-and-trade system on CO2 emissions will prove feasible he wrote in his recent book The Age of. This then yields a price of carbon. I do not disagree with any of the points offered by the experts I just personally lean.

Issue Date August 2013. Carbon taxes and cap-and-trade are the two big ideas US. With a carbon tax there is.

With cap-and-trade units of carbon are initially given out for free meaning there is no upfront cost to firms. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. Currently the carbon tax is Rs 400 per ton.

Cap and trade or emissions trading is a common term for a government regulatory program designed to limit or cap the total level of specific chemical by-products resulting from private.

Shankar Ias Summary Of Mitigation Strategiess Notes Study Environment Additional Topics For Upsc Cse

Carbon Credit Carbon Sequestration Carbon Tax And Carbon Offsetting Youtube

Carbon Emissions Trading Need Working Pros Cons Alternatives Upsc Ias Express

Carbon Credit And Carbon Offset What Makes Them Different

Upsc Dna 24th Jan 2015 Gs Today

Unfccc Kyoto Protocol Unfccc Summit 1997 Carbon Trading Pmf Ias

Upsc Gs Paper I 2022 B Answer Key Along With Explanation Edukemy Upsc Gs Paper I 2022 B

Cap And Trade Vs Taxes Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Carbon Emissions Trading Need Working Pros Cons Alternatives Upsc Ias Express

Shankar Ias Summary Of Climate Change Organizations Notes Study Environment Additional Topics For Upsc

27 Main Pros Cons Of Carbon Taxes E C

Unfccc Kyoto Protocol Unfccc Summit 1997 Carbon Trading Pmf Ias

Insights Daily Current Affairs Pib Summary 15 July 2021 Insightsias

Why To Impose Carbon Tax In India Important Topics For Upsc Exams Ias Exam Portal India S Largest Community For Upsc Exam Aspirants

Why To Impose Carbon Tax In India Important Topics For Upsc Exams Ias Exam Portal India S Largest Community For Upsc Exam Aspirants